Which Factor in Valuing Your Company Is the Most Important

There is a saying that good management can fix a poor business but poor management will ruin any business. A company that has been able to achieve 10M or more in gross revenue while maintaining benchmark or greater margins is viewed as a better opportunity than a company of lesser size.

Qualitative Factors Top 10 Qualitative Factors In Valuation

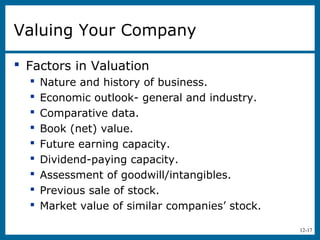

The value factor involves assessing a stocks most appropriate value based on the underlying companys fundamental business metrics.

. Conversely the lower the discount rate the higher your business will be valued all other things being equal. Most business have the Product thing covered delivering a. 4 Competitive Advantage.

Company size is a commonly used factor when valuing a company. Essentially if your business has high growth potential it can add value to the company. Typically the larger the business the higher the valuation will be.

To better assess the value of your business here are the most common factors to consider. 3 Customers and Geographic exposure. This is another common method of valuation and is based on the idea that the actual value of a business lies in the ability to produce revenue in the future.

You do this by dividing your customers into large average and small purchasers. 2 Quality of Management. A second aspect which allows you to determine the value of your customer base is the revenue for which a customer or customer segment is responsible.

Assessing the value of human capital HC the most important asset of any organization has long been easier said than done. The team members with relevant competences and a positive track record will be more likely to build a successful company. 1 Companys Core Business.

Quality healthcare is far and away the top benefit that employees value the most. According to 2020 job statistics one out of four people accepted or turned down a job because of the offered benefits. The property or land that your business occupies or owns has a large impact on a business value.

There are a lot of methods of valuation under the earning value approach but the. Get to know your neighborhoods -- and the types of houses you find in them -- inside and out. The industry in which a company operates will be extremely important in determining valuation.

A Future earnings capacity B Book valueC Outlook of the economy D Market price of similar companies stocks Answer. Not surprisingly the higher the discount rate the lower your business enterprise value today. If a company operates in a hot industry it is likely that it will be able to achieve a higher valuation compared to another company in a different industry at the same stage of development and current traction.

Why Your Business Valuation Could Be The Most Important Thing You Do. Valuing anything that matters businesses products contracts people is a risky business. People makes the difference.

If your business leases a building the amount of time remaining on the lease is an important factor. Growth plays an important role in the value of companies because all value is forward-looking. 5 Corporate Governance.

Your projected earnings usually EBITDA and the discount rate used. The Value Of Human Capital. According to a study by Hinge Research Institute valuation experts look at the following factors when appraising a construction firm.

Factors to consider when pricing a home are. If it is too low it can have a negative impact on the business. If your lease ends in less than three years it could lower the multiple of your business because the new owner will have to renegotiate the lease.

Although every one of them is just as important as the other one the most important critical success factors for growing business will always be Money Marketing and Product. If you consider the sale of your company as well as correctly valuing your business you will have to go through different stages to help you maximize the final price. This shows you which part of your customers or customer segment is responsible for the largest share of your revenue.

To retain employees and strengthen your workforce its important to understand what employees value and the components of employee satisfaction. The more growth the company experiences the more free cash flow the company can generate which is attractive to a potential buyer. A great team is nearly the most important factor in the company valuation.

Most value funds use several value factors including price to. This factor determines how likely your business is to grow in the future. Company size is also a driver of business value since a prospective buyer assumes a larger company has less risk than a smaller company.

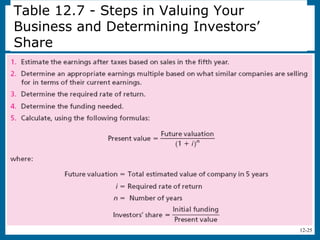

Which factor in valuing your company is themostimportant. To find leverage in the business model and to search for scalability is one of the most important soft quality factors when assessing the value of a business. 53 which factor in valuing your company is the most.

Rankings are based on a zero to 10 scale with 10 being most important to obtaining a premium valuation Strength of existing client relationships 839 Technology 800 Quality of management team 786. The most important fact to consider is whether you have a. It is essential to value your company because it is your principal tool for the sale of your company.

Think of yourself as. 6 factors that influence a homes value. So the DCF is dependent on two factors.

Measuring Your Most Important Assets. Settle too low or too high. Top 10 Qualitative Factors in Valuation.

This is because smaller companies have little market power and are more negatively impacted by the loss of key leaders. 6 Industry Growth Trends. A Future earnings capacity.

Returning to the original question which is more important to the value of your company.

.png)

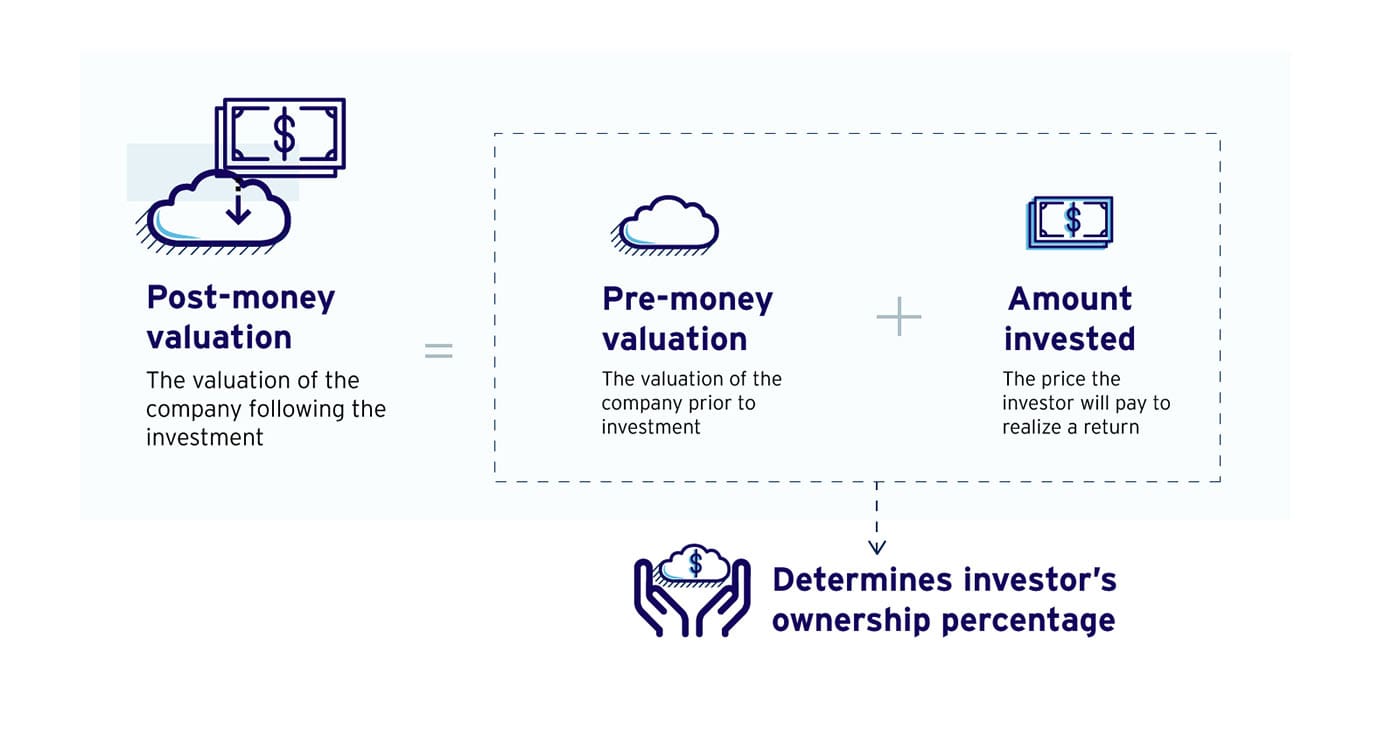

How To Value Your Startup Company Seedlegals

2014 Qfd Symposium Training Knowledge Management Knowledge Change Management

Startup Valuation The Ultimate Guide To Value Startups 2022 By Pro Business Plans Pro Business Plans Medium

4 Best Ways To Calculate Valuation Of A Startup With Calculator

Different Ways Of Valuing Your Startup Start Up Start Up Business Finance

4 Best Ways To Calculate Valuation Of A Startup With Calculator

Five Aspects To Consider When Valuing A Business Company Valuation Services

Pin By Growth Factors On Values Business Valuation Valuing A Business Public Company

Importance Of Company Valuation Business Valuation

Business Valuation Factors The Top 9 Things To Consider Valentiam

Pin On Positive Affirmations Quotes

Prosperity Through Property Property Propertymanagement Properties Realestate Realestatei Real Estate Investor Real Estate Investing Property Management

Comparable Company Analysis Relative Valuation Excel Template

Valuation Methods Three Main Approaches To Value A Business

Business Valuation How Investors Determine The Value Of Your Business Entrepreneur S Toolkit

What Factors Contribute To The Valuation Of A Company

Gefallt 2 436 Mal 58 Kommentare Reynabiddy Auf Instagram Loving Someone You Deserve Instagram Posts

Comments

Post a Comment